INTRODUCTION

The recent flooding in Myanmar began in the first week of September, primarily triggered by heavy monsoon rains and the remnants of Typhoon Yagi. Central Myanmar has been the most affected, with regions such as Nay Pyi Taw, Bago, Kayah, Kayin, Magway, Mandalay, Mon, and eastern and southern Shan experiencing severe flooding. The floods have led to extensive damage, including disrupted road networks, transportation, telecommunications, and electricity. Despite some areas beginning to see receding water levels, most affected regions remain inundated, highlighting the severity of the situation

SITUATION OVERVIEW

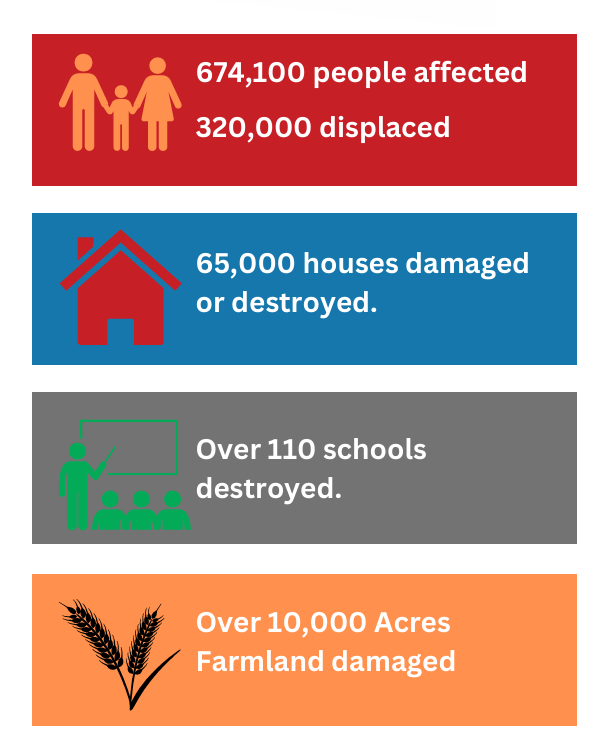

The recent flooding in Myanmar has had a profound impact across the country. Authorities have reported over 200 people died due to the severe weather, and over 320,000 people have been displaced, with more than 236,000 currently sheltered in around 187 relief camps. The disaster has caused significant destruction, including the loss of tens of thousands of homes and hundreds of schools. Critical infrastructure, such as roads and bridges, has been damaged, leading to widespread power and communication outages. The flooding has also resulted in severe soil erosion and environmental contamination, impacting agriculture and local ecosystems. Health risks are rising due to compromised sanitation and clean water access, further exacerbating the humanitarian crisis. The extensive damage and disruption highlight the urgent need for effective relief and recovery efforts to support affected communities and restore normalcy

EASTERN SHAN STATE

The current flooding in Eastern Shan State has led to widespread disruption and severe damage. 18,000 people in the region have been affected, with thousands forced to evacuate their homes. Several townships, including Keng Tung, Tachileik, and Mong Hpayak, have been hit hardest by the floods, resulting in many residents being relocated to temporary shelters

SOUTHERN SHAN STATE

74,000 individuals were displaced by heavy rains and flooding in Southern Shan State, with people’s livelihoods affected and houses destroyed. 14 townships, including Kalaw, Nyaung Shwe, Shwe Nyang, Pindaya, Hsihseng, and Pinlaung, have been among the hardest hit, with many low-lying areas facing severe waterlogging. The crucial source of livelihood has suffered immensely, with thousands of acres of paddy fields and vegetable farms flooded and crops destroyed. Infrastructure damage has also been significant in Southern Shan State. Several roads, including routes connecting remote villages to main townships, have been blocked or washed away by landslides, disrupting transportation and making it difficult to deliver aid

MANDALAY REGION

Mandalay Region – In the Mandalay Region, severe flooding has affected at least 10 townships, resulting in 76 fatalities and damage to approximately 26,700 houses. Yamethin Township, one of the hardest-hit areas, has reported at least 30 fatalities due to drowning, while more than 80 people remain missing. In Wundwin Township, due to the breach of the Sa Mone Dam, an estimated 40,000 acres of agricultural land have been submerged, severely affecting the region’s agricultural sector and threatening the livelihoods of many farming communities. The disaster has also impacted 110 schools, 80 state buildings, and 251 electric poles, along with numerous road networks and bridges.

KAYAH STATE

Kayah State has been hit hard by severe flooding, particularly in IDP camps and low-lying areas, leading to widespread displacement and infrastructure damage. Excessive water released from the Mobye Dam has affected nearly 9,200 people across four townships.

NAYPYITAW

In Nay Pyi Taw, the flooding impacted more than 60,000 people across Naypyitaw Council, Tatkone, Zeyathiri, and Pobbathiri. Heavy rainfall, exacerbated by the remnants of Typhoon Yagi, led to widespread waterlogging and overflow of local waterways.

BAGO REGION

The situation is severe across the Bago region, with an estimated 87,000 individuals impacted in six townships, including Htantabin, Oktwin, Phyu, Taungoo, and Yedashe. Flooding has significantly worsened, particularly in Taungoo Township, where around 1,200 households have been affected, and approximately 5,000 people have been displaced to 13 evacuation centers. In Taungoo, the floods have displaced thousands and led to tragic losses. Two local volunteers lost their lives while attempting to rescue affected residents, highlighting the dangerous conditions in the area.

MAGWAY REGION

In the Magway Region, the floods have severely affected 6 townships, leading to the evacuation of around 7,000 people from 15 villages near Yaw Creek, including residents from internally displaced persons (IDP) camps.

MON STATE

In Mon State, heavy rains and the rising water levels of the Bilin River have forced the temporary relocation of more than 900 people in Bilin and Kyaikhto towns. These individuals were moved to relief centers as a precautionary measure to ensure their safety amidst the worsening flood conditions

NEEDS AND RESPONSE EFFORTS

Local donors and private citizens, including celebrities, have rallied to support the affected communities. Many have raised funds and donated essential items such as food, clothes, and medicines. However, logistical challenges have hindered efforts to reach the most severely impacted areas. Some remote villages remain inaccessible due to ongoing flooding and damaged roads, limiting aid distribution.

Donations are being distributed in areas where access is still possible, but a more coordinated and large-scale response is required. Local authorities and humanitarian organizations are working to deliver aid. Still, additional support is needed from both the government and international organizations to ensure that relief reaches those in the most remote and severely affected regions. The focus now must be on overcoming access barriers and scaling up relief operations to meet the immediate needs of all affected communities.

PRIMARY IMPACT AND SIGNIFICANT CHALLENGES

The primary impact on the communities has been the loss of crops and agricultural fields, particularly paddies, damaged by mud intrusion. This has severely affected the income of these communities. A significant challenge they now face is rebuilding houses, needing more funds and building materials. Additionally, ensuring a sufficient food and water supply has become a significant concern in the aftermath of the flooding. Flood management in Myanmar also faces several challenges, including inadequate infrastructure, limited disaster preparedness, and the increased frequency of extreme weather events due to climate change. Addressing these issues requires a coordinated response involving immediate relief and long-term strategies for sustainable recovery.

HELPING FLOOD VICTIMS IN MYANMAR: WHAT CAN WE DO

The recent flooding in Myanmar has created an urgent humanitarian crisis, with thousands of people displaced and in need of basic necessities. Based on reports from affected areas, the most pressing needs include:

- Food: Due to the widespread damage to farmlands and disruption of supply chains, many communities are experiencing food shortages. Immediate food relief is required, particularly in hard-to-reach areas where local markets have been submerged or destroyed. While aid is being delivered, the most urgent needs include dry foods and durable food supplies to ensure long-term support for affected communities.

- Drinking Water: Contaminated water sources due to flooding have made access to clean drinking water a major concern. Many areas are relying on bottled water, but the supply needs to be increased.

- Medicine: The risk of diseases, such as waterborne illnesses and infections, has increased due to stagnant water and the poor sanitation conditions in shelters. There is an urgent need for medical supplies, including antibiotics, basic first aid, and preventive vaccines. Additionally, healthcare access is limited in some affected regions.

- Clothes: Many families have lost their personal belongings, and providing clothes and dignity kits, especially for women and children, is essential. These kits typically contain sanitary products, soap, and other hygiene essentials to maintain dignity and health in emergency shelters.

- Shelter: Thousands of homes have been destroyed or severely damaged, forcing people to take refuge in temporary shelters. Tents, tarpaulins, and construction materials are urgently needed to accommodate the displaced population and to provide them with safe, dry, and secure living conditions.

- Crops and Seeds for Replanting: Many farmers have lost their entire harvest due to the floods. Providing high-quality crop seeds, farming equipment, and modern technologies for farm repairs are essential to kickstart their farming activities for the next growing season.

SECONDARY DATA IS GATHERED BY MAGNIFY PLUS RESEARCH IN ASSOCIATION WITH MAGNIFY MYANMAR